Though the state and federal income tax deadlines have been extended to May due to the ongoing pandemic and the dispersal of economic stimulus payments, April is still considered the _ month for taxation.

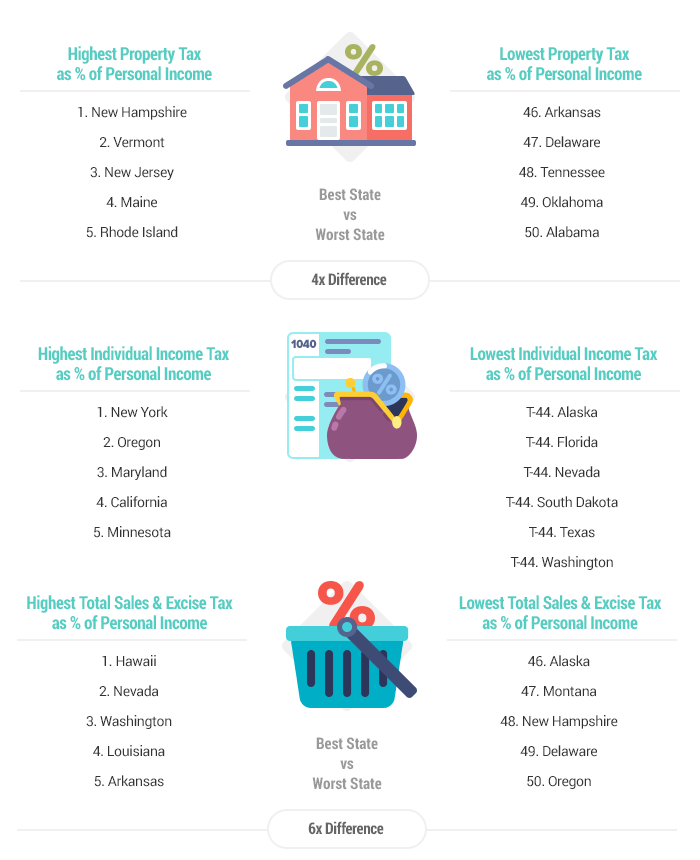

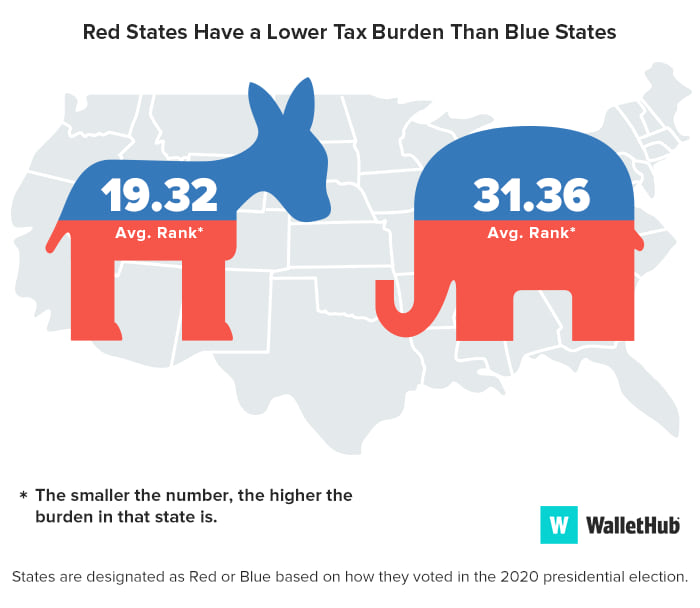

Personal financial website WalletHub recently compared the 50 states across three components of state tax burden — property taxes, individual income taxes, and sales and excise taxes — as a share of total personal income.

We take a look at the comprehensive findings in this week’s Map Monday.

| States with Highest Tax Burdens (%) | States with Lowest Tax Burdens (%) |

| 1. New York (12.79%) | T-40. Alabama (7.45%) |

| 2. Hawaii (12.19%) | T-40. Montana (7.45%) |

| 3. Vermont (10.75%) | T-40. South Carolina (7.45%) |

| 4. Maine (10.50%) | 43. South Dakota (7.37%) |

| 5. Connecticut (10.44%) | 44. Oklahoma (7.13%) |

| 6. Minnesota (9.99%) | 45. Florida (6.97%) |

| 7. New Jersey (9.98%) | 46. New Hampshire (6.84%) |

| 8. Rhode Island (9.69%) | 47. Delaware (6.21%) |

| 9. Illinois (9.52%) | 48. Wyoming (6.14%) |

| 10. California (9.48%) | 49. Tennessee (5.74%) |

| 11.Kansas (9.36%) | 50. Alaska (5.10%) |

As for the Peach State, Georgia ranked No. 35. Our state ranked 33rd for property tax burden, 23rd for individual income tax burden, and 36th for Sales & Excise tax burden.

7.91% of the income of Georgians, on average, went to state-oriented taxes – 2.59% for property taxes, 2.38% for individual income taxes, and 2.94% for sales and excise tax burdens.

Key Stats – Tax Facts Infographic

- 79% of Americans don’t know if they’ll owe income taxes on their stimulus checks (they won’t).

- Americans spend 8 billion hours doing taxes each year. The average person spends 12 hours and $230 completing their 1040.

- 90% of tax returns are expected to be filed electronically. The average refund in 2021 is $3,021, as of 2/26/2021.

- 30% of people say making a math mistake is their biggest Tax Day fear, and 29% worry most about not having enough money. That edges out identity theft (22%) and getting audited (19%).

- 38% of Americans would move to a different country and 27% would get an “IRS” tattoo for a tax-free future.

- 50% of people would rather do jury duty than their taxes. 1 in 4 would prefer talking to their kids about sex. More than 10% would swim with sharks, spend the night in jail and drink expired milk.

You can read more about the study and the methodology here.