Fifteen years after employees first requested that the idea be considered, Bulloch County Commissioners voted to overhaul employee retirement plans.

The change voted in on Tuesday night means employees will soon have the option to convert their retirement plans to a defined benefit plan, as opposed to the current plan with a defined contribution. That same change means employees will have a guaranteed monthly benefit once they reach the age of retirement.

Tuesday’s Meeting

County employees from all departments once again lined the halls, the commission room, and the steps outside the building, awaiting a vote. The decision was delayed in mid-October after Chairman Roy Thompson broke a tie to hold off until the November meeting. Commissioners Simmons, Mosley, and Gibson had all said they needed more time to evaluate the analysis and the plans provided to them some two weeks prior.

The somewhat anticlimactic vote was unanimous, despite a lack of discussion or even a real indication of what commissioners were voting upon. After Chairman Roy Thompson prefaced that the issue was a ‘rollover from a previous meeting,’ he asked for a motion, which Commissioner Anthony Simmons made, saying only ‘I make a motion to approve.’ The motion was seconded by Commissioner Timmy Rushing and it passed 6-0 in a hand vote. There was no further discussion.

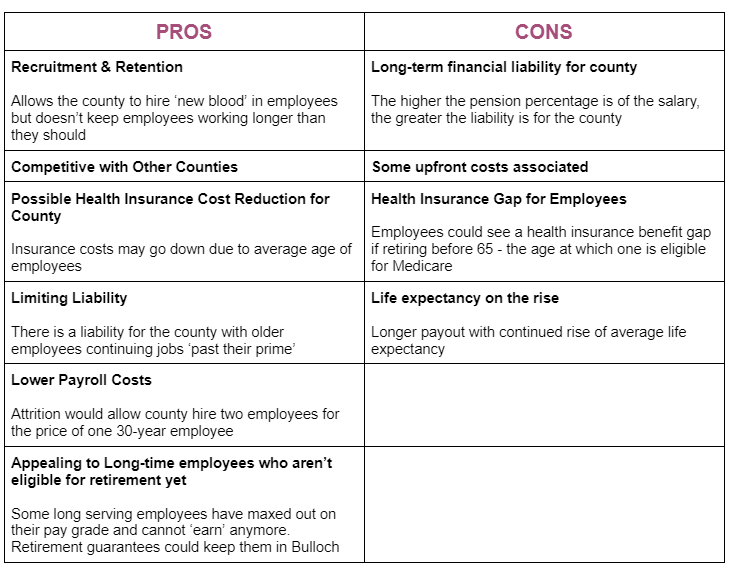

Tuesday’s vote also followed a series of employee-led workshops over the last year in which a committee of employees from various departments presented proposals to commissioners. The committee was formed after Sheriff Noel Brown petitioned commissioners in September 2021 to make good on a promise to explore retirement options roughly a decade ago. County employees enlisted the assistance of ACCG Retirement Services, which provided a cost-benefit analysis to the county at no expense.

Immediately following the vote, employees gathered outside the building and they applauded the committee members who advocated for the changes on their behalves over the last year.

Defined Benefit vs. Defined Contribution

Bulloch County currently offers a defined contribution plan, which invests contributions made by both the employer and the employee into an account, which is in turn invested in stocks. Subsequently, the value relies on market conditions via 401a and 457b employee retirement plans. The County contributes 6.5% of participating employee’s gross earnings into a 401a defined contribution plan and adds a 50% match of up to 2% of gross earnings into the 457b account.

Employees, however, have long advocated for a defined benefit plan or some hybrid combination of the defined benefit and defined contribution. Both alternatives provide eligible employees guaranteed income when they retire using a formula based on factors such as the employee’s salary and years of service. Advocates of reform say the latter options allow employees to better plan for their retirement instead of retiring and then learning what benefit they will receive, subject to fluctuations in the market conditions.

Defined Benefit Plan Approved by the County Commission

The new plan will be a quasi-option for all current employees, though new employees will be required to participate in the defined benefit plan, as opposed to the defined contribution plan.

Current employees will have the option to relinquish their 401a balance in exchange for credited service in the defined benefits plan. Employees would then receive vesting and credited service back to their hire date and they would retain the balance in their 457 accounts with no additional county contribution.

Employees not comfortable with the buyout can maintain their 401a plans, subject to market changes but no additional funds will be deposited into their account. They would then enter the defined benefit plan on the effect date starting with 0 years of credited service. The 457 plan would still remain untouched with no additional county contribution.

The Basic Plan as approved includes:

- A 1.5% multiplier

- Vesting after 5 years

- A retirement age of 65

- Unreduced early retirement at age 60 with 30 years of service

- Reduced early retirement at age 60 with 10 years of service

For employees who are under age 65, a blackout period will be in effect for one year, barring retirement until that date. For employees who are 65 years of age or older, the blackout period is six months.

Law enforcement and firefighter pensions will also halt under the new plan as of the effective date and the county will no longer be responsible for funding those pensions. The county will, however, offer payroll deductions for those first responders if they wish to have the dues paid out of their paychecks.

Bulloch Commissioners Divided on Decision to Again Punt Employee Retirement Overhaul

COLUMN: Give Bulloch County Employees What They Deserve