Employees say the county’s lackluster retirement plan is costing Bulloch County valuable members of the workforce, driving up healthcare costs, and subjecting the county to avoidable liabilities.

That’s what commissioners heard during a report on retirement plan proposals during Tuesday’s meeting.

“I’ve been here for 20 years. I’ve been with the Sheriff’s department since I was 20-years-old. In my 20 years, I’ve never seen an employee leave the Sheriff’s Office and go back to the police department. Never…When the city changed their retirement to a 60% pension, for the first time ever, I saw people leave the Sheriff’s Office to go back to the police department. Why did they leave? Retirement. What we have is nowhere near what the city has. What we have is nowhere near what Chatham County has. We can’t compete with them.

For recruitment, people come in, their question is ‘What is the county retirement?’ and the answer is ‘Let me explain it to you real quick.’ and then you explain it to them and you never see them again.”

– Captain Marcus Nesmith, Bulloch County Sheriff’s Office.

Background

In September 2021, Sheriff Noel Brown approached commissioners about reinstating a retirement committee formed in 2007. Then, the committee was established for the purposes of evaluating different types of retirement plans for county employees and post-employment health insurance benefits, though no action was ever taken. While Brown was there on behalf of his own employees at the Sheriff’s Office, any plan revisions, he told them, would positively impact all county employees. Following Brown’s presentation, Commissioner Timmy Rushing moved to reestablish the committee and the measure passed unanimously.

The committee comprised of employees from every department within the county and met several times last fall to evaluate and consulted with a representative from the Association of County Commissioners of Georgia (ACCG) to evaluate initial and long term costs for employees and taxpayers.

Bulloch County currently offers a defined contribution plan, which invests contributions made by both the employer and the employee into an account, which is in turn invested in stocks. Subsequently, the value relies on market conditions. FY 2022 budget documents show the county offers a 401a/457b employee retirement plan. The County contributes 6.5% of participating employee’s gross earnings into a 401a defined contribution plan. It also adds a 50% match of up to 2% of gross earnings into the 457b account.

Employees, however, have long advocated for a defined benefit plan or some hybrid combination of the defined benefit and defined contribution. Both alternatives provide eligible employees guaranteed income when they retire using a formula based on factors such as the employee’s salary and years of service. Advocates of reform say the latter options allow employees to better plan for their retirement instead of retiring and then learning what benefit they will receive, subject to fluctuations in the market conditions.

The committee members worked with their respective colleagues in their agencies and departments to share feedback with ACCG. The organization conducted an analysis at no cost to the county and presented four different options. Those options were then provided to the committee for consideration as well as the commissioners and county staff ahead of Tuesday’s meeting.

(Note: Retirement benefits for sheriffs and other constitutional officers are handled by the state, so Brown would not be impacted by any alteration in benefits)

Reasons for Desired Changes

Captain Marcus Nesmith of the Bulloch County Sheriff’s Office presented the multi-page report along with committee recommendations during Tuesday’s commission meeting. A number of committee members from other departments were also in attendance, as was Sheriff Brown and a few members of his administrative command staff.

Nesmith told commissioners in addition to competitiveness, the revisions to employee retirement would eliminate some liability, particularly as it pertains to older employees in their seventies driving county trucks and vehicles. Nesmith said some wish to work, but many haven’t retired simply because they don’t know what to expect. “I think if we can give them the opportunity to retire, then we owe that to the employees,” Nesmith said.

He also said the plans just aren’t sufficient for living after offering half of their life – so far – to the county. “We have 30, 35-year employees who have around $300,000 in their retirement. That’s it. Can you retire on $300,000 at 65-years-old? The answer is probably not. Just basic math and not considering interest or anything – if you took $30,000 a year, you’d be broke by the time you’re 75-years-old.”

Alternative Proposals to Commissioners

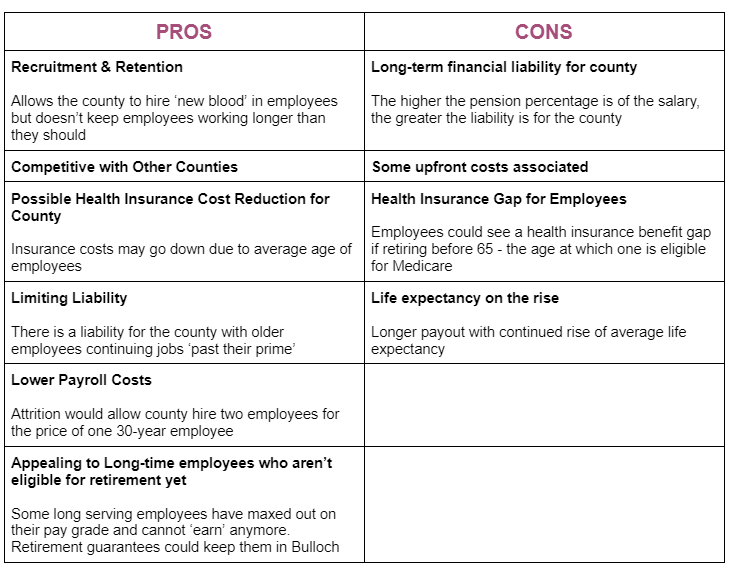

Ultimately, Nesmith said two of the four plans were appealing to county employees and staff understood the other two options were not viable. (See page 2 of document below)

Scenario 2 – Hybrid plan with a 45% defined benefit pension and an 457(b) plan which would have employees contributing 4% and the county contributing 2%. Employees would be vested after five years.

The multiplier would be 1.5% of the final annualized average monthly compensation.

Scenario 3 – Defined benefit plan of 52% of an employee’s salary with an employee being vested after seven years. An employee could retire at 55 years old.

The multiplier would be 1.75% of the final annualized average monthly compensation.

Nesmith said Scenario 2 was good, but employees really liked Scenario 3 and would allow the county to be competitive.

Both plans have an upfront ‘unfunded liability’ for the county, however, if the county opted to go through ACCG’s pool for converting the retirement plans, the initial liability could be amortized over 20 years.

For Scenario 2, the estimated unfunded initial liability to the county would be $4,055,500. Amortized over 20 years, the estimated annual payment would be $269,100.

For Scenario 3, the estimated unfunded initial liability to the county would be $9,809,900. Amortized over 20 years, the estimated annual payment would be $650,900.

“We know and we understand that it’s not just going to be free. We’re going to have to put something into this and I think we’re all willing to do that to come up with a better retirement plan,” Nesmith told commissioners.

“This is a big ask. But we ask that you take your time and you do your due diligence and you decide. Which is the most viable and you come back in this room and you vote. I think that’s a fair ask for all the employees,” Nesmith said.

Here is the complete PDF provided by ACCG (story continues below)

https://cdn.thegeorgiavirtue.com/wp-content/uploads/2022/04/ACCG-analysis-Bulloch-County-Retirement-1.pdf

Commissioner Comments

Commissioners were not prepared to make a decision on the issue during Tuesday’s meeting. Chairman Roy Thompson expressed concern about how much such a move would require taxes to be increased.

“There’s 425 employees in the county, but 83,000 we have to answer to. Maybe we can get this for the same amount of money. I don’t know,” Thompson said. “I want you to have everything the taxpayers can afford. I really don’t know. Someone’s got to pay for it. We need to be knowledgeable because of how many people we are representing. We need to have a workshop with the board, the committee, ACCG, and any other employees that want to come…let’s discuss.”

Thompson also asked if employees knew they were ‘giving up money.’ “Do employees know they’re going to write a check back to the county for what they have so far?” Thompson asked Nesmith.

“The ones I have talked to, yes. They understand that,” Nesmith said. “They know they’re going to give it back and get a bigger return in the end. It doesn’t just go away and never come back.” Nesmith also told commissioners that most employees are already putting in above the minimum contribution and are willing to do so to fund the plan.

“I’m a small business owner and there are lots of small business owners that don’t offer any retirement benefits,” Thompson said.

Commissioner Curt Deal echoed the desire for a workshop. “There are lots of variables. Lots of good that can come of this, but I want to make sure we’re all on the same page and we can all live with what’s going to come.”

Commissioner Walter Gibson said he was interested in a workshop so they could evaluate how to ‘help the honest, good people that serve our county every day and night.’

County Manager Tom Couch also asked Nesmith if, in evaluating the plans, employees considered the reduction in retirement age from 65 to 62 and the impact of retiring before one is eligible for Medicare. Nesmith said that wasn’t considered because the priority for the committee was retirement.

“I think these plans are attractive enough to generate some retirements in this county. People who won’t stay until they’re 65 or 70-years-old,” Nesmith said.

Commissioner Timmy Rushing was not in attendance at Tuesday’s meeting.

What Other Counties Do

For comparison, other counties offer retirement benefits as follows:

| COUNTY | PLAN TYPE | MATCH | # OF YEARS BEFORE VESTED | MULTIPLIER(For Defined Benefit Plans) |

| City of Statesboro (Pop. 31,495) | Defined Benefit 457(b) option | 60% of salary at retirement | 5 years (age 65) (55 year old retirement for public safety after 25 years of service) | |

| Barrow (Pop. 83,240) | Defined benefit + 401(a) | ? 401(a) match is 3% | 5 years | Depends on years of service |

| Cobb (pop. 760,141) | Defined Benefit with a defined contribution add-on option | In FY 2021, county paid 24.15% of employee base pay County will match up to 4% of 401(a) | 100% vested after 10 years | 1.0% |

| Effingham (pop. 64,296) | Defined contribution457(b) + 401(a) | County pays:–3% on 401(a)–up to 3% match on 457(b) after 1 year | 5 years | |

| Fayette (pop.114,421) | Defined Benefit | Employee is required to contribute 5% | 10 years | 2.0% |

| Glynn (pop. 85,292) | Defined Benefit (phased out for new employees beginning in mid-2021 due to funding shortfalls) | 10 years(age 65) | ||

| Liberty (pop. 61,435) | Defined contribution457(b) + 401(a) | County matches 401(a) contribution, % unclear | ||

| Rockdale (pop. 90,896) | Defined Benefit With defined contribution add-on option | 90% of salary at retirement | 5 years |

Retirement benefits remain a contentious topic for local governments and employees. Just this week, in Hall County, a judge once again ruled in favor of a county in its decision to convert from a defined benefit plan to a defined contribution plan back in 1998.