A federal judge sentenced Eugene R. “Trey” Britt III in court on Wednesday for his crimes related to his former ownership in several bars and restaurants. Britt entered a guilty plea to the charges last fall.

Charges Against Trey Britt

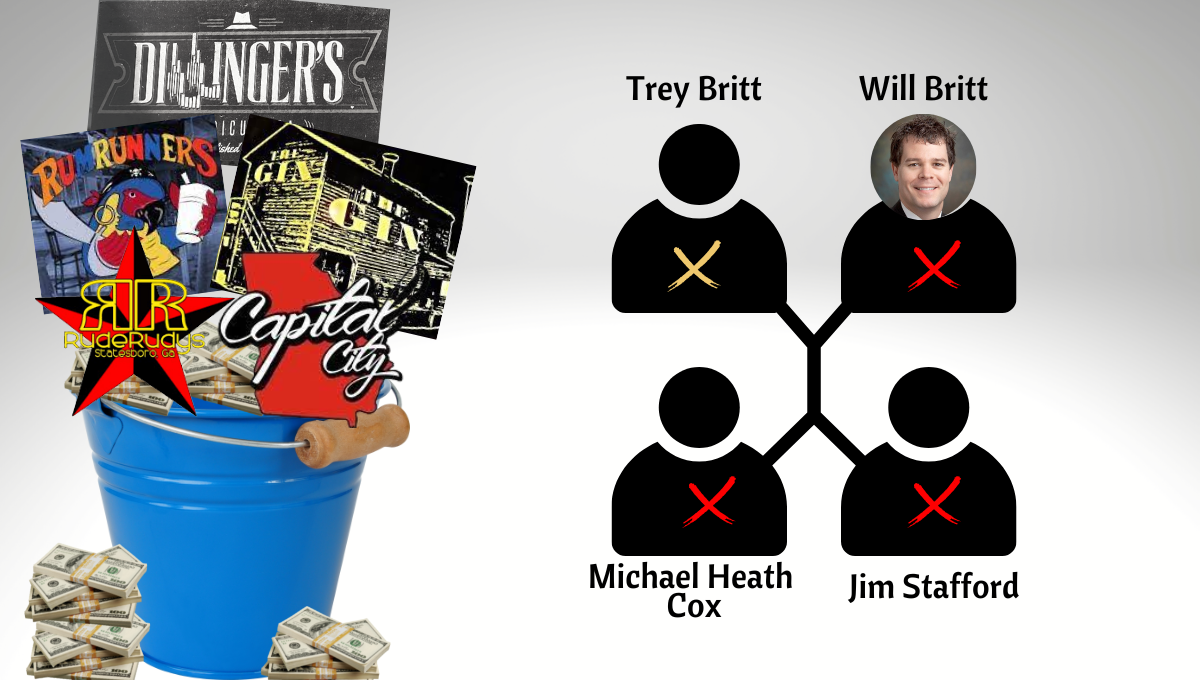

Federal prosecutors filed an Information Accusation against Eugene R. “Trey” Britt III on September 13, 2022, two weeks after his brother and former Statesboro City Councilman, Will Britt, was sentenced in federal court. The charges almost mirror those filed against the other Britt who entered a guilty plea in federal court in April 2022. In August, a federal judge sentenced Britt to serve 33 months in prison, followed by three years supervised release, and pay $350,000 in restitution.

For Trey Britt, the government’s accusation alleged Britt failed to report sources of income on his tax returns. The DOJ claims that “[f]or at least two decades, [Trey Britt] and others used this organizational structure to conduct business for businesses in the bar and restaurant industry. Accordingly, although it did not appear on paper that the Defendant owned or operated any bars or restaurants since at least 2010, he actually owned varying percentages in the establishments described above, among others.”

Specifically, Britt had ownership in Capital City and 119 Chops, Rude Rudy’s, Rum Runners, The Gin, and Title Town Nightlife LLC (Dillinger’s). The Accusation references a company, BGRG Inc., a reported acronym for Big Goofy Restaurant Group. ‘Big Goofy’ has long been a nickname for Trey Britt.

Further, the Accusation alleged that Trey Britt:

- owned a majority interest in Capital City, Chops, and Rum Runners and controlled the distribution of cash from those three establishments.

- provided false information to a Sylvania accountant regarding cash distributions from Capital City, Chops, Rum Runners, Rude Rudy’s, The Gin, and Dillinger’s

- despite all of the cash collections, Trey Britt’s 2015 tax return showed a $127,290 loss

- also assisted in and derived income from the sale of beer at Music Festival 1.

- These sales involved cash only and the beer sales operation received fifty percent of the profit.

- Similar to the structure of the Britt’s bars and restaurants, Britt and others shared in the profits of the beer sales operation by skimming cash and disbursing it to themselves in accordance with their ownership percentages.

- Britt received at least 35% percent of the cash profits that the beer sales operation received.

In September 2022, a ‘Notice of a Plea Agreement’ was filed in the case file and a hearing was scheduled in October to accept Trey Britt’s guilty plea.

Sentence

With Britt’s charge, he faced a maximum of 5 years in prison, a $250,000 fine, up to three years supervised release, reimbursements for the cost of prosecution, and a $100 special assessment.

Britt’s attorney, Murdoch II Walker, who is based out of New England, asked the judge for a downward deviation Wednesday, saying that the issue was “not some sophisticated tax evasion scheme” and it was a group of friends and family who wanted to enjoy time and who wanted to provide enjoyment to others

“That’s not to diminish the crimes but this is not a public corruption case, your honor,” Walker said. “He is not his brother and it was his brother, a public figure, who brought the case more attention.”

Walker contended that it was not a criminal organization and that the tax evasion occurred in the course of ‘every day operations.’ “It happens way too often but I don’t want the optics to be that he and his brother were leaders of some criminal enterprise,” Walker told the court.

He asked the court to consider house arrest or probation only, but in the event that prison time was necessary, he asked for the minimum sentence of eight months because Britt accepted responsibility, agreed to take a plea early on in the process, and was willing to accept the consequences.

“This case is not who Trey Britt is. He is a salt of the earth person. A hard worker. And he’s made selfless contributions to society,” Walker said. He also told the court that had they allowed everyone who wanted to come in support of Britt to show up, the courtroom would be “packed.” On Wednesday, Britt had three members in the courtroom for his support.

Britt briefly addressed the court and said he took full responsibility for his actions. “I’m happy to be here to get this one step closer to getting it over with,” he said.

The US government had a different position in Britt, however, and contended that Britt’s attorney may be confused about the facts.

Assistant US Attorneys argued that no deviation from the sentencing guidelines was warranted because this was neither sloppy business practices nor a lapse in judgement.

“He did it for two decades and he did it with other businesses. It was a normal part of his business operations, which he helped set up, and he would still be doing it if he hadn’t been caught. Yes, they were legitimate businesses but tax evasion was built in to the operations.”

The US government also said that Britt lied to his accountant to continue the scheme, lied to federal agents, and lied in a 2018 civil deposition.

“He does not deserve extra credit. He was not a passive participant. He helped other people cheat on their taxes and managed the system to do it.”

Ultimately, Chief Judge J. Randal Hall of the U.S. District Court for the Southern District of Georgia sentenced Britt as follows:

- 24 months to serve in federal prison

- 3 years supervised release

- $362,249.53 in restitution to the IRS

- $10,000 fine

- $100 special assessment

- Submission of DNA sample

- Submission of urine samples while on release

- Prohibition of owning firearms

The judge also ordered Britt to abide by additional conditions including:

- Waiver of 4th amendment searches

- Providing access to financial records to probation

- He may not use more than one bank

- He may not open a line of credit without approval from probation

- He may not be self employed without approval from probation

- Curfew from 10pm to 6am daily

Britt was ordered to turn himself in to the custody of the Bureau of Prisons on August 21, 2023. His family asked that he be sentenced to serve in Montgomery, AL, which the judge noted but cannot guarantee.

Direct Contradictions to Previous Statements Made Under Oath

Like his brother’s case, Trey Britt’s guilty plea is a direct contradiction to statements made between 2014 and 2018, during which period both Will and Trey Britt “denied under oath that they ever had a financial interest in or otherwise provided any financial backing to Rum Runners…”

In a 2016 Memorandum of Law against the City of Statesboro by the family of Michael Gatto in a lawsuit after his death, attorneys for the City of Statesboro denied any sort of liability in the death of Gatto, which occurred in the University Plaza parking lot, in part because the Britts had no ownership in the bars, as the Gattos alleged.

The document goes on:

“Will and Trey Britt were asked about a recent FBI raid, and both invoked their 5th Amendment privilege against self-incrimination when asked whether ‘documents or other records obtained by the FBI in that search show indications of your having financial interest in one or more businesses at University Plaza during the year 2014.’ (SMF 108) However, Will Britt denied, and did not invoke the 5th Amendment, when asked if he owned either Rude Rudy’s or Rum Runners…”

“While Plaintiffs have speculated that Will or Trey Britt may have had some secret interest in Rum Runners or Rude Rudy’s, they denied as much…”

The City denied having any responsibility for the circumstances that facilitated the University Plaza environment, going as far as to create a loophole if the Britts had been untruthful under oath. “Even if Mr. Britt had some secret undisclosed interest in Rum Runners or even Rude Rudy’s” the city was not responsible for the bars, it said.

Much of the Gatto lawsuit relied on the actions of Will and Trey Britt, which meant most of the city’s defense relied on distinguishing between ‘City Councilman Will Britt’ and ‘Will Britt and his brother, Trey Britt.’

“No adverse inference can be drawn against the City because neither Will Britt nor Trey Britt is a party to this action. But even if the Court were to consider drawing any alleged adverse interference in ruling on summary judgment, it would not support an argument that Will or Trey Britt held an interest in any of the University Plaza Establishments.”

Finally, the City of Statesboro argued that “speculation as to the ownership of various establishments or what Will Britt may have been doing in “counting money” is inadmissible hearsay.

A trial court judge, an appellate court judge, and the Georgia Supreme Court all ruled against the Gatto family over a period of eight years.