A decision by Governor Brian Kemp to redirect CARES Act funding in hopes of avoiding an unemployment tax increase has outraged one of his vocal opponents who will not receive a second payout due to the reallocation.

Kemp announced Wednesday that upwards of $1.5 billion in Coronavirus Relief Funds from the CARES Act would be allocated to repay borrowing for the Georgia Unemployment Insurance Trust Fund to prevent increases in state and federal unemployment taxes. By year’s end, the Georgia Department of Labor (GDOL) estimates that the state Unemployment Insurance Trust Fund will have borrowed a total of $1.5 billion in response to the COVID-19 pandemic’s impact on Georgia’s labor force.

“COVID-19 has brought unprecedented challenges to nearly every business – large and small – and upended the lives of millions of Georgians,” Kemp said in a news release. “Through no fault of their own, thousands of people became unemployed overnight, businesses were shut down, and countless families suffered. Today’s announcement will save Georgia employers millions of dollars in state and federal unemployment taxes, prevent significant layoffs, and save the state millions of dollars in interest payments. By directing these Coronavirus Relief Funds to the Trust Fund, we will ensure we’re prepared to meet the needs of struggling Georgians in the months to come and support businesses across the Peach State who are putting people back to work and serving their local communities.”

By allocating up to $1.5 billion in Coronavirus Relief Funds for this purpose, Georgia will save the average Georgia employer approximately $350 per year for each employed worker.

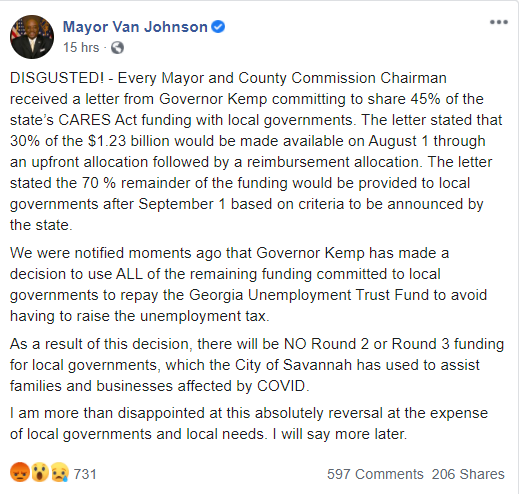

But Savannah Mayor Van Johnson expressed his disdain for Kemp’s decision on social media immediately after the news broke.

More than 430 applications for the second round of CARES Act funding through the City of Savannah were applied for in early September, with a total request of about $7 million in COVID-19-related losses. The Savannah Morning News reported at the time that City Manager Pat Monahan said only 80-100 of the applicants would receive help. “From the very beginning I don’t think any of us expected the City of Savannah to have sufficient funds to help all businesses, but it does show the amount of need in the community,” Monahan said.

With benefit payments projected to outpace tax revenue, Georgia will have to continue to borrow federal funds to pay benefits. After the Great Recession of 2008-2009, it took three years until tax revenue outpaced benefit payments on an annual basis. By 2023, without raising employers’ tax rates for unemployment insurance and without a capital injection, the GDOL estimates the state could borrow another $1 billion to pay benefits. With a substantial loan balance for three years, Georgia employers would also lose Federal Unemployment Tax Act (FUTA) tax credits, resulting in a cost of $85 million per year, compounded annually. By 2025, FUTA tax credit losses would have cost Georgia employers $500 million. Although economic forecasters predict that tax revenue will outpace benefit payments by this time, the difference would not be enough to repay the debt.

“Without the transfer of funds, the state will have to increase unemployment tax rates for employers between 300% and 400% to make headway on paying off the loan,” said Georgia Department of Labor Commissioner Mark Butler. “This reallocation of federal funds will allow more employers across the state to focus on the growth and success of their businesses without having the additional pressure of a rising unemployment tax.”

The Georgia Chamber of Commerce, the Metro Atlanta Chamber, and the Georgia Chapter of the National Federation of Independent Business (NFIB) all commended Kemp’s action Wednesday evening.

“2020 has been a challenging year for Georgia’s small business owners and employees. Today’s announcement means people who lost their jobs through no fault of their own because of the pandemic will have the support they need until they can return to work, and it relieves the financial pressure on the General Assembly to raise taxes on small businesses in order to support the Georgia Unemployment Trust Fund.” – Nathan Humphrey, State Director, NFIB Georgia

Kemp is also committing up to an additional $400 million of the Coronavirus Relief Funds for the state share of matching funds for FEMA grants, Georgia National Guard expenses, continued hospital staffing augmentation, and state COVID-19 response expenses.

Governor Kemp previously announced $113 million of CARES Act funds to Georgia nursing homes, $105 million in GEERS funds to support student connectivity and education, and $371 million in direct support to local governments for COVID-19 related expenses.