Every year, the average U.S. household pays nearly $11,000 in federal income taxes. And while we’re all faced with that same obligation, there is significant difference when it comes to state and local taxes. Taxpayers in the most tax-expensive states, for instance, pay more than twice as much as those in the cheapest states.

According to personal financial website WalletHub, tax worries will take a backseat to stress about inflation in 2024.

Source: WalletHub

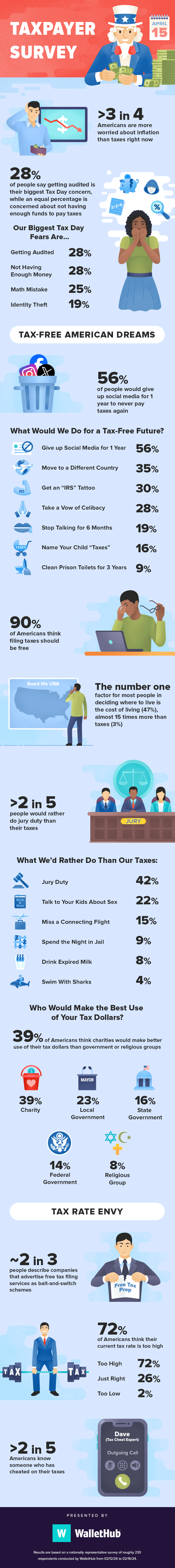

2024 Taxpayer Survey

- Over 3 in 4 Americans are more worried about inflation than taxes right now.

- 72% of Americans think their current tax rate is too high.

- 28% of people say getting audited is their biggest Tax Day concern, while an equal percentage is concerned about not having enough funds to pay taxes.

- 39% of Americans think charities would make better use of their tax dollars than government or religious groups.

- More than 2 in 5 Americans know someone who has cheated on their taxes.

- Nearly 2 in 3 people describe companies that advertise free tax filing services as bait-and-switch schemes.

- 90% of Americans think filing taxes should be free.

| States with the Lowest Tax Rates | States with the Highest Tax Rates |

| 1. Alaska | 42. Texas |

| 2. Delaware | 43. Ohio |

| 3. Wyoming | 44. Nebraska |

| 4. Idaho | 45. Iowa |

| 5. Montana | 46. Kansas |

| 6. Colorado | 47. Pennsylvania |

| 7. Nevada | 48. New Jersey |

| 8. South Carolina | 49. Connecticut |

| 9. Florida | 50. New York |

| 10. District of Columbia | 51. Illinois |

Advertisements